Written by Crosbie DesBrisay

The Bank of Canada has announced a 25-basis-point rate cut, lowering the policy rate from 2.75% to 2.50%.

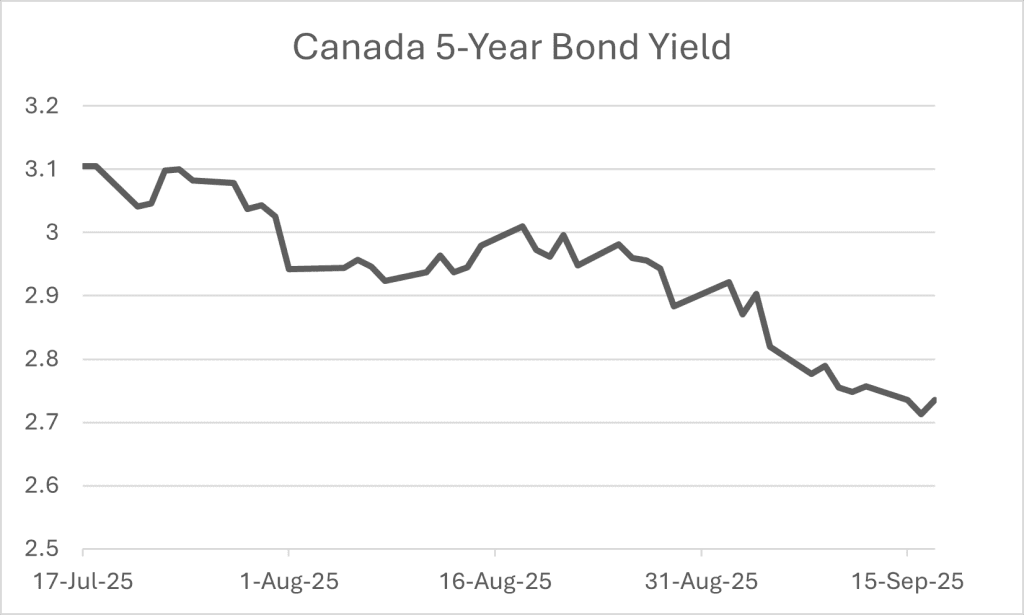

For multifamily owners, the impact depends on financing structure. Properties with floating or prime-based debt, including bridge or construction loans, benefit immediately through lower interest costs, reducing annual carrying expenses and improving cash flow. Owners with fixed financing will see no immediate change. However, borrowers approaching a renewal or looking to purchase have already begun to partially benefit. The adjustment has been reflected in bond yields, as anticipation of the cut has lowered yields throughout the month. Overall, borrowing has become more affordable, supporting investment opportunities in the multifamily sector.

Here is what the major banks are predicting*:

TD – A move down to 2.25% in Q4 2025, with rates holding steady at that level through 2026.

CIBC – A decline to 2.25% by December 2025, then unchanged through 2026.

RBC – RBC had expected the rate cut to be a close call, and does not anticipate additional cuts. (RBC Forward Guidance Sept 15, 2025)

BMO – A drop to 2.25% by December 2025, followed by another step lower to 2.00% through 2026.

Scotiabank – A cut to 2.25% in 2025, before moving back up to 2.75% through 2026.

Lower interest rates can stimulate buyer demand, improve market sentiment, and potentially support stronger valuations. Reduced borrowing costs create opportunities to pursue acquisitions, enhancing returns and creating favorable conditions for both active investors and long-term owners.

If you are interested in the market value of your property, looking to acquire a new property, or have any questions, please reach out to a member of the NAI Apartments team below. The NAI Apartments team specializes in apartment and mixed-use sales and has completed over $3 billion in transactions. Visit NAIapartments.ca to view our latest listings and sales.

*Source for bank forecasts: “Where Every Big Bank Stands On Wednesday’s Interest Rate Announcement,” Storeys, September 15, 2025.